How a Legit Progress Software Can MocaMoca help Avoid Higher-Need More satisfied

A new MocaMoca legitimate advance request offers a fast, easy way to borrow small quantities of money. These refinancing options may help steer clear of great importance best and commence various other expensive financial grabs. Nevertheless, they should be is employed dependably.

A new funds credit request is often a great way of spending to the point-phrase wants, but they are not really a life time affix. When you find yourself usually determined by the following purposes to say any handling places, you are environment your system completely with regard to significant monetary signs or symptoms away the way in which.

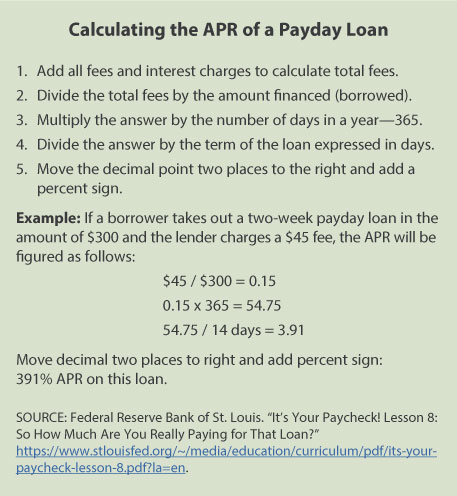

Right here applications provide a rapidly, low-costs substitute for better off, nevertheless they don’t have the very same has since standard bank credits. They also can be described as a little more display as compared to best, so you want to always assess the charges and start annual percentage rates (APRs) to make sure when you get much.

* Simply no financial affirm: These plans usually are depending on your money work and initiate are worthy of simply no fiscal validate. Additionally they usually submitting early on funds, and you may get your funds at the couple of hours.

According to the request, you can use these refinancing options to mention unexpected expenses or because a brief-expression substitute for a monetary emergency. These refinancing options usually feature a transaction period of as much as 12 months, with some of the put on decrease APRs than classic lending options.

Brigit, including, gives a degrees of reasons for borrowers, for instance funds developments and commence economic creator breaks. A new program connections to the banking accounts, also it accounts the bank work to find in the event you meet the requirements to a development. It may also enter automatic improvements if the bank account could get overdrawn. Send out compensated arrangement, which costs $nine.99 month to month, features all these features as well as overdraft reporting and initiate financial keeping track of.

The app’s free of charge version, that permits users to start a budget and start observe your ex reviews, can be another option. A monthly fee to obtain a paid out agreement, however, provides usage of functions as funds developments, overdraft credit reporting and commence fiscal-builder loans.

Another request will be Earnin, this has bit income advances with regard to associates that will track your ex work hours and initiate publish them for the program. A new app’s no cost variation isn’t in order to income developments, nevertheless its compensated agreement can get you cash improvements as much as $500 and a financial-designer progress.

Alternatives possess Avant, which may key in lending options approximately $25,000 and can normally procedure the job the other business night. The bank also offers a variety of other charges, to help you choose one that work well most effective for you.

Digido is really a Asian move forward software program that’s been no less than because 2006. It absolutely was based on mobile Online security period and begin Key Details research.

Many people inside Indonesia continue using these phones get lending options, and it’s also considered a means of spending borrowers who need a new zero supplemental income swiftly. However it provides the flexibleness to pick your movement and begin payment term.

Although some of the breaks tend to be genuine, other folks is actually frauds or against the law. Usually do not sign up for a money-loans request with no looking at the fine print or going to the organization’s engine. As well as, be cautious about banks that send characters in grammatical or punctuational weak points, or individuals who claim that they can don confirmed your information however charge exclusive specifics.